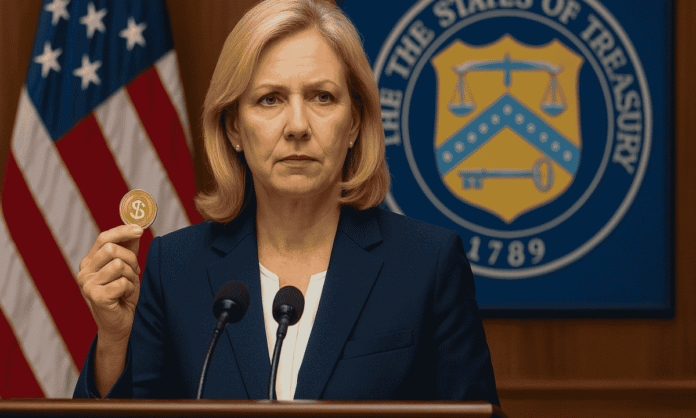

The carpet in the Treasury’s briefing room is heavy enough to swallow the sound of nervous shoes. That’s useful these days, because the country’s fiscal hydraulics—those unseen pipes that keep the dollar humming—need quieter nerves than markets can often afford. Into this scene walks Treasury Secretary Bessent, crisp, unflustered, and surprisingly direct for a town that lives on ellipses. The message, pared to its bones: stablecoins aren’t a sideshow anymore. Under the so‑called “Genius Act” framework, they’re being drafted into service—deliberately—to steady demand for Treasury bills and, by extension, the costs of financing the government’s nonstop rhythm of auctions.

It sounds, at first blush, like a tidy policy sentence. In practice, it’s a tectonic nudge: marry the restless speed of crypto’s dollar proxies with the sober ballast of T‑bills, and maybe—just maybe—you get a safer, saner digital dollar economy without waiting for a federal CBDC to crawl out of committee.

The invisible plumbing behind a very visible dollar

Stablecoins are a strange species. They move with social media speed yet mimic the patience of banknotes; they live online, but their promises are decidedly old‑world—one token, one dollar, ring‑fenced and redeemable. The crack in the promise has always been reserves: what’s behind the curtain? Cash? Bills? “Other stuff” that sounds safe until it isn’t?

Bessent’s push reframes that anxiety. If the framework channels stablecoin reserves into short‑duration Treasuries with clear custody, daily transparency, and redemption discipline, the token becomes less alchemy, more instrument. Think money market funds with an API. The benefit to Washington is blunt: a larger, steadier bid for bills. The benefit to markets: cleaner, more standardized disclosures, fewer “trust me” attestations, and a direct line between digital liquidity and America’s safest paper.

A quiet pact with markets

The Genius Act idea—however one feels about its name—reads like a pact: regulators set the rails, stablecoin issuers agree to live on them, and in return, the Treasury market inherits a new, technology‑native class of demand. It’s not a revolution so much as a lubrication. Every month, the government rolls mountains of short‑term debt. Every day, stablecoins mediate billions in on‑chain payments and arbitrage. Linking the two turns volatile private issuance into something that politely aligns with public financing.

If you’ve ever watched a T‑bill auction from the side of a trading floor (the muted cheers, the quick recalculations of spreads), you know how fragile “steady demand” can feel when rates are fidgety. A structural buyer matters. So does predictability. If stablecoin treasurers must keep, say, 70–90% in cash and T‑bills with strict duration caps and real‑time attestations, they become a sort of rhythm section for the front end of the curve—never soloists, always on time.

Why crypto diehards might welcome this

There’s an old, romantic streak in crypto that bristles at anything that smells like policy. Yet the most practical founders—particularly those who survived 2022’s bruises—have wanted this for years: explicit rules, permissible assets, custody that passes a bank examiner’s sniff test, redemption queues that are measured in hours, not press releases. If the cost of legitimacy is parking reserves in government paper, many will pay it gladly. The bonus is composability: an on‑chain dollar backed by T‑bills becomes a credible building block for payments, credit, and tokenized collateral—without the ambient dread of “what if those reserves don’t clear?”

There’s a human texture to this, too. Accountants breathe easier when the assets are plain vanilla. Corporate treasurers, who quietly control the world’s risk budgets, start greenlighting pilots when the legal memos don’t read like horror stories. Developers ship faster when compliance isn’t a choose‑your‑own‑adventure.

The tradeoffs no one should gloss over

Of course, every clean line casts a shadow. Steering billions—eventually, perhaps, trillions—of crypto‑native reserves into government debt can crowd out risk capital elsewhere. If the safest yield in town is inside a stablecoin reserve, what happens to the appetite for riskier on‑chain credit? Also, tying digital dollars to public finance strengthens the dollar’s reach in crypto but chisels away at the romance of “uncorrelated.” In a crunch, if redemptions spike, will issuers be forced sellers, feeding feedback loops into front‑end rates?

Privacy and surveillance worries don’t vanish, either. The more official the rails, the more structured the compliance. Expect wallet‑level rules, sanctions logic embedded at the token‑smart‑contract layer, and geographic controls. Programmable money cuts both ways; it can include, and it can exclude—with a precision that will unsettle civil libertarians.

How it plays out on real desks

Picture a payments startup in Austin. Today, they wire dollars to a merchant in Seoul, eat FX spread, wait T+2, and send apologetic emails. Tomorrow, they push a whitelisted, bill‑backed stablecoin over an L2, with fees in pennies, for final settlement. The merchant parks it or converts locally, all while a real‑time attestation shows that somewhere in a New York custodian, a matching slice of T‑bills sits soberly earning a front‑end yield. The startup reconciles in minutes, books close cleaner, CFO sleeps better.

Or a market maker balancing books across exchanges in New York, Dubai, and Singapore. Instead of juggling five banks and weekend dead zones, they run 24/7 with a dollar instrument that behaves like cash in code and like a T‑bill in reserve. Spreads compress. Volatility loses a little of its bite at the edges.

The Fed, the curve, and the unsaid thing

Bessent’s subtext—seasoned readers will hear it—is about the quiet power of the front end of the curve. If stablecoins become a reliable conduit into bills, the Treasury gains an extra hand on the tiller: more predictable absorption of issuance without leaning harder on primary dealers or testing the patience of money funds. It doesn’t change the macro cycle, but it trims frictions. In an era where basis points are policy bullets, that’s not trivial.

And hovering behind this: the CBDC question. A state‑operated digital dollar is still contentious. A private, tightly regulated, T‑bill‑backed stablecoin regime is the adjacent possible—politically easier, technically ready, operationally aligned with how money already works. It’s the future that feels suspiciously like the present, just more efficient.

What to watch next

- Reserve rules with teeth: precise duration caps, concentration limits, custody segregation, and redemption SLAs that market participants can price and trust.

- Attestation that isn’t theater: independent, frequent, machine‑readable proofs, plus penalties that bite when disclosures slip.

- Interoperability without chaos: guardrails for cross‑chain portability so the “dollar” doesn’t fracture into a zoo of wrapped lookalikes with inconsistent guarantees.

- Crisis drills: tabletop exercises for liquidity stress, including coordinated backstops that don’t rely on vibes.

By late afternoon, the briefing room will empty. Staffers will fold chairs; a stray memo will get tucked into a binder that’s thicker than it should be. Markets will do what they do—overreact, correct, then overreact in the other direction. But the arc is visible. The dollar is becoming more programmable, and crypto’s most useful product is becoming more legible. If Bessent gets the balance right, the result won’t be splashy. It will be like good infrastructure: mostly invisible, available on Sunday, and boring in the best possible way.

In a capital that often confuses noise for action, that’s a quiet victory worth paying attention to.